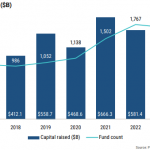

Tech-focused venture capital firm Inovia Capital has collected $334m for its first continuity fund from fellow buyout houses BlackRock, HarbourVest Partners, Northleaf Capital Partners, Hollyport Capital and Kensington Capital Partners.

The $1.9bn-managing firm said the new fund will invest in nine high-performing portfolio companies including Bench Accounting, Clearco, TopHat, TripleLift and AlayaCare..

Mike Pugatch, managing director at HarbourVest Partners, said, “General partners are increasingly looking for solutions that allow them to offer a liquidity option to their investors as they seek to extend the life of their investments, and we are pleased to have brought our long-standing expertise in the secondary market to bear in structuring this continuation fund with Inovia.”

Chris Arsenault, partner at Inovia Capital, said, “This first continuation fund is an important milestone for Inovia, broadening its reach and furthering its strategy to build global, sustainable tech companies.

With Inovia Continuity Fund I, we are equipping ourselves to support companies beyond the traditional venture capital cycle. This is part of the firm’s roadmap to support entrepreneurs from seed to IPO and beyond.”

The Canadian VC firm raised $600m across its fourth early-stage fund and a new growth-stage vehicle in 2019, securing $400m for its growth-stage fundraise.

It teamed up with Canadian pension fund CDPQ last year to invest $37m in home care software provider AlayaCare.

Copyright © 2021 AltAssets