Trending Now

Fund news

UK, Ireland B2B software investor Axiom Equity scores above-hard-cap Fund II...

UK and Ireland-focused private equity house Axiom Equity has hit an above-hard cap final close for its sophomore fund, bringing its assets under management to more than $500m.

Deal news

Deal Roundup: Goldman Sachs Alts leads $65m Sage Series C, Littlejohn...

Goldman Sachs Alternatives' growth equity unit has led a $65m Series C round for Sage, an integrated care platform built for senior living and skilled nursing.

People news

Maven unveils succession as MacKinnon becomes managing partner, founder Nixon steps...

UK alternative investor Maven Capital Partners has named long-time exec Ewan MacKinnon as managing partner, replacing firm founder Bill Nixon as part of the firm's planned succession strategy.

Features

Private equity suffers ‘lethargic’ three years – but investors remain bullish...

Private equity has endured a tricky three years as the boom from the end of the Covid-19 pandemic slowed - but investor confidence in the asset class remains high for 2025, research from Preqin shows.

LP News

CPPIB, Equinix buy data centre player atNorth from Partners Group at...

The Canada Pension Plan Investment Board has teamed with Equinix for a joint purchase of Nordic data centre provider atNorth from Partners Group at a $4bn enterprise value.

Knowledge Bank

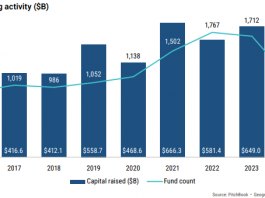

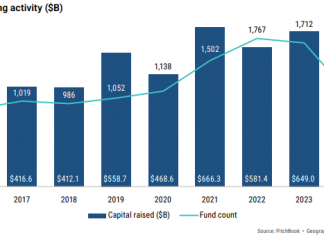

PE fundraising suffers weakest year since 2020 amid exit, distributions challenges:...

Private equity fundraising slowed for the second consecutive year in 2025 as a lack of exits weighed on both distributions and the ability for LPs to reinvest in the asset class.

Popular Articles

UK, Ireland B2B software investor Axiom Equity scores above-hard-cap Fund II close without formal...

UK and Ireland-focused private equity house Axiom Equity has hit an above-hard cap final close for its sophomore fund, bringing its assets under management to more than $500m.

Deal Roundup: Goldman Sachs Alts leads $65m Sage Series C, Littlejohn & Co invest...

Goldman Sachs Alternatives' growth equity unit has led a $65m Series C round for Sage, an integrated care platform built for senior living and skilled nursing.

Ex-NFL players Terrence C. Murphy Sr, Reggie Bush eye $150m for debut sports fund

Former record-setting NFL wide receiver Terrence C Murphy Sr has founded a new private equity firm aimed at buying controlling stakes in emerging leagues and "related sports ecosystem assets".

Axiom Partners eyes ‘AI for the Real World’ with $52m debut fund close

Early-stage investor Axiom Partners has closed its oversubscribed inaugural fund on $52m, with eyes on backing companies offering practical applications for AI.

PE fundraising suffers weakest year since 2020 amid exit, distributions challenges: PitchBook

Private equity fundraising slowed for the second consecutive year in 2025 as a lack of exits weighed on both distributions and the ability for LPs to reinvest in the asset class.

AlbaCore Capital teams with MUFG Bank, Mitsubishi UFJ Trust & Banking to launch infra...

Alternative credit specialist AlbaCore Capital has launched a new infra debt strategy through a tie-up with MUFG Bank and Mitsubishi UFJ Trust and Banking Corporation.

Galvanize, co-founded by billionaire Tom Steyer, seals $370m for decarbonisation-focused RE fund

Galvanize, the energy, industry and infrastructure modernisation asset manager co-founded by investment billionaire Tom Steyer, has raised a $370m real estate fund.

Firstpick aims to be ‘fairy godmother who knew Cinderella before the ball’ with €25m...

Lithuania-based early stage investor Firstpick has launched a news €25m fund targeting Baltic startups which "may be overlooked by traditional VC criteria".

Investcorp picks up more than $1.25bn to close second GP staking fund

The GP staking arm of global alternatives firm Investcorp has raised more than $1.25bn for its sophomore fund and related vehicles.

STG seals rapid hard cap final close of second Allegro fund on more than...

Enterprise software-focused private equity house STG has hauled in more than $1.3bn for the hard cap final close of its second Allegro fund targeting lower mid-market deals.