Resource constraints haven’t stopped one of the first sovereign wealth funds from cashing in on direct investments and co-investments, proving the strategies are not just a bolt-on for fund investments.

AltAssets spoke to Alaska Permanent Fund Corporation chief investment officer Marcus Frampton, to better understand how the fund went from barely touching private equity to it becoming a core part of the investment strategy.

Frampton said on average, the team is spending around half of its time on co-investments or direct investments, despite only allocating 20 to 25 per cent of its capital towards of those type of investments.

“It’s central and it’s a big driver of our returns,” he added.

Since inception, APFC’s fund investments have generated an IRR of 13.3 per cent with and multiple of 1.5, while its direct- and co-investments saw returns of 60 per cent and a multiple of 2.6.

Back in 2012 the fund’s allocation to private equity stood at just 3 per cent, as it invested through gatekeepers which had the discretion to pick funds.

It was at this time, the former chief investment officer, Jay Willoughby, expressed his vision for the fund to engage in direct investing.

So before the organisation even began investing in funds directly, Willoughby lead two very large direct private equity deals to begin a strategy that the APFC remains committed to today.

One deal saw the APFC invest $700m in Californian REIT, American Homes 4 Rent, alongside Public Storage founder B Wayne Hughes.

Around that same time, the fund also invested $125m in Seattle-based biopharmaceutical company, Juno Therapeutics, a deal also led by Willoughby.

When Willoughby started the direct programme, he wasn’t too concerned with fund investments just yet, as the direct deals were proving more interesting. Yet, like other institutional investors, fund commitments would also become a key feature of APFC’s strategy.

“We said okay, if we’re doing biotech Series A, we should probably be picking our own funds,” Frampton said.

“Private equity has been a real effort here in the last seven years, and that was the impetus, back with Jay who was a few CIOs ago doing those big deals.

“It turned out great and when your first couple deals are big and they’re both really successful it makes it a lot easier to do subsequent stuff, because the board has some comfort and really, the risk is that everyone thinks it’s easier than it really is.”

Since then, the APFC has continued to grow its direct and co-investment activity, Frampton explained.

“At the same time he was doing those direct deals, he was encouraging me to do direct in infrastructure, but my approach was co-investing with the mangers [whose funds] we were [invested] in, which was a little more comfortable.”

More recently the fund’s head of private equity Steve Moseley led an investment round for Boston-based agritech Indigo Agriculture and last year, APFC was also a lead investor in a preferred stock round for infrastructure firm Generate Capital.

Although the fund’s direct investment and co-investment activity have offered superior returns when compared with its fund commitments, it typically requires a lot more resources and manpower.

“We are still very understaffed in my opinion, so our whole investment team is 25 people,” Frampton said. “If you look at our alternatives team and they cover hedge funds, private equity venture, infrastructure, private credit, that team is about six people today.”

“So what we’ve done is hired people that have M&A experience or direct private equity experience and we’re pretty selective on who we hire.

“As a result most of the alternatives team have been around deals and have gone through an investment bank analyst programme. Although APFC has recently started hiring associates out of MBA programs with the goal to develop talent internally.”

“I would take one person who was an investment banking analyst at JP Morgan for three years over four people who had been fund investors their whole lives.”

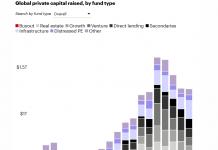

The fund currently invests across a range of strategies and sectors, but its currently placing a big emphasis on private credit co-investments.

Frampton said that the space isn’t too populated at the moment and that make its attractive for investment. The strategy also relates to where the global economy may be in the cycle, he added.

“Those deals move really fast so at any given time we’ve got a couple situations we are looking at.”

Within private equity, the fund is avoiding the mega buyouts to focus more on the mid-market with smaller managers, whether it be in Europe or the US.

Infrastructure is another area in which the APFC has spent a lot of time co-investing in since 2012. The fund has typically issued much bigger cheques for infra deals than they have in private equity and private debt co-investments, Frampton said.

Looking forward, Frampton is pretty confident about the areas they’re investing in currently.

“I think we’re going to continue to get outperformance from private equity, I’m pretty pessimistic about the public markets too.”

“Based on where cyclically adjusted P/E multiples are today, I wouldn’t be surprised if public stocks return one per cent annually for the next decade.”

Copyright © 2019 AltAssets