Global buyout giant KKR has tapped its €5.8bn European Fund V to acquire a significant minority stake in Körber’s supply chain software business

Körber’s supply chain software provide customers with warehouse management solutions for varying operational complexities through software, voice and robotics solutions. It has a customer bass of 4,200 across 70 countries.

The firm said structural trends and market forces including e-commerce, multi-channel and micro-fulfillment all amplified the need for digital solutions to handle increased volume and greater supply chain complexity.

Its investment will grow the company’s geographic footprint and accelerate the transition to SaaS, automation and robotics, the firm said.

Christian Ollig, head of KKR for DACH, and Jean-Pierre Saad, head of technology for private equity in EMEA at KKR, said in a joint statement, “A seamless and highly automated supply chain is business critical for enterprises of all sizes and we see significant growth potential in this market.

“Körber’s supply chain software business is already one of the leading providers with excellent expertise and capabilities in WMS including robotics and voice, led by an industry-leading management team.

“We look forward to the strategic partnership with Körber and to leveraging our experience of growth acceleration with global software businesses, as well as partnering with management, to help Körber’s supply chain software business reach its full potential in this attractive market.”

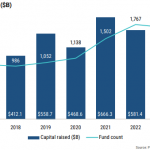

KKR closed European Fund V in 2019. The fund focuses on private equity-related transactions in the core markets of Western Europe.

Other KKR investments in technology include Cegid, Exact Software, Cloudera, Darktrace, MYOB, Onestream, Epicor, iValua and Visma,

Copyright © 2021 AltAssets