Software might be eating the world, but the next wave of pioneering food tech startups are where technology and eating really meet. But where does the future lie, beyond the current zeitgeist for alternative proteins and advances in agriculture? AltAssets’ Karin Wasteson spoke to a string of food tech investment pioneers about what they think the sector’s next big thing might be.

As awareness and the significance around sustainable food systems increase, and the alternative food product universe is becoming more diverse, finding the next big idea within the food tech segment could be worth a fortune.

Add to this the war in Ukraine and geopolitical instability throughout the world, and it’s evident that securing food supply chains will be a necessity going forward.

An early investor in alternative dairy company Oatly, VC firm K2 Global, which is based out of both Singapore and the US, has been investing in food tech for the better part of a decade. The firm’s founder Ozi Amanat, author of The Foodtech Revolution, was an early backer of startups like Spotify, Airbnb, Uber, Coinbase, and Impossible Foods.

Amanat believes we are now in the 2.0 phase of food tech. So what are some of the frontier trends within food today? Cell-based meats and fats is a very exciting area according to Amanat, and he would like to see more on the alternative milk side.

“We’re looking at products that are disruptive, that are not going anywhere. But there are also developments on the leading edge, “including creating protein out of thin air, for example,” he said.

When it comes to innovation within food tech, Amanat says that we need to take baby steps before we can take quantum leaps. “I’m very excited to be a part of the so-called “food tech mafia”, supporting the development of this area going forward,” he added.

Growing appetite

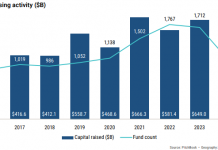

Indeed, food tech VC funding is on the road to recovery after three quarters of declines, according to a new Pitchbook food tech report, released in the beginning of March. Deal value stabilized in Q4, and the sector noted its second-largest quarterly deal count on record.

“Hopefully that stability will lead to stronger performance in the following quarters,” said Alex Frederick, author of Pitchbooks latest food tech report. PitchBook analysts expect investment across food tech to fully recover as markets improve.

The emerging food tech report logged $2.8 billion invested across 316 deals in Q4 2022. Notable exits in Q4 include the IPO of online grocer Foodison on the Tokyo Stock Exchange and the acquisition of Imperfect Foods by rival Misfits Market.

Total deal value in 2022 fell by a stunning 56.5% year-on-year however—following an extraordinarily active 2021.

But despite the drop since 2021, 2022 values fell in line with five-year historical medians. “In 2021, deal count increased to 2000 deals, versus 1,400 deals taking place in 2020. A lot of that was due to e-commerce during the pandemic,” explained Frederick.

In terms of M&A activity going forward, Frederick believes we could see an increase in cash acquisitions but overall a decrease in the near term – until we see interest rates come down.

“There are companies out there that have strong balance sheets that could do cash acquisitions, and acquire some attractively valued companies,” he explained.

Future Food

The alternative protein space saw the second highest inflow of capital, according to the report. In 2022, Pitchbook recorded 18 acquisitions of alternative protein companies and 16 bankruptcies or closures, including Noops, Longève, and Cell Farm.

Kellogg’s had plans in 2022 to sell alt-protein brand MorningStar Farms. Market volatility and rising interest rates have created a challenging environment for M&A, however.

The report also highlights emerging opportunities in sugar alternatives, generative AI in the food industry, and food production in space. “Another interesting trend is the growing interest in commercial and recreational space travel, which comes with a need to develop technologies to produce food in microgravity environments,” Frederick noted.

“There’s also the issue of food security. Locally produced meat provides a more secure food supply, versus relying on long supply chains which saw disruption at the beginning of the pandemic,” said the Pitchbook expert.

When it comes to innovation within food tech, AI can be used to create new recipes, analyze food trends, and optimize food production processes for already existing businesses.

Hussein Kanji, analyst at Hoxton Ventures, has spent years spotting the next big idea and investing in what, at times, later turn out to become unicorns.

He believes that people have become much more discerning about food in general, and healthy food choices in particular, since the pandemic.

“It makes sense for more brands to flourish both during and post-pandemic as people care about these kinds of products more,” he said.

New Categories

Hoxton Ventures was one of the early investors in food-delivery company Deliveroo, which listed on the London Stock Exchange in April 2021.

“In the last five years there have been developments like table-oriented ordering, or systems that make it easier for restaurants to do things behind the scenes; EPOS systems to aggregate restaurants purchasing power with suppliers, and these things all got funded and scaled up to become big businesses,” explained Kanji. “There are a couple in the US that have done well despite the pause on restaurants during the pandemic.”

“With food products, it’s harder to figure out what the next big thing will be because the greenfield territory has shifted to these new products,” explained Kanji.

“We’re looking for a new category creation, where we see a new market being born, which is likely to be the winner in that category, and we’re looking for teams that are hiring well beyond their capability.”

“As people become more conscious of what they are eating, there are a whole group of new categories that are emerging to explore there: plant-based cheeses, plant-based meats.”

He continued: “We will be trying to figure out whether [a new product is] genuinely a new category. Sometimes these categories take a lot of money to establish. The beyond-foods are a good example of this: it takes hundreds of millions of dollars to create the category. A lot of these categories get created in the US, rather than in Europe, and the rest of the world consumes.”

The ongoing quest for finding the next generation of sugar alternatives has caught Kanjis attention, even though he laments “having missed the opportunity” somewhat.

“There are a few companies that are building the next generation of sugars. That could potentially be a big new market,” Kanji said.

Copyright © 2023 AltAssets