Faced with a frothy market and increasing competition for fund access, Swedish institutional investment major AFA Insurance is happy to wait patiently for the right combination of features in a fund manager, its head of alternative investment has told AltAssets.

Mikael Huldt said fee levels issued by private equity fund managers have remained relatively stable, even though fund-sizes have been steadily growing since the last financial crisis. He added that he has seen a lot of GPs in the market currently building out their teams and offices, so in his view their compensation is pretty fair.

Instead, he said the SEK220bn-managing AFA was more focused on the GP commit – the amount of capital fronted by the fund manager for any given private investment vehicle.

“We’ve seen a lot of liquidity, there have been a lot of distributions of carried interest and performance fees,” said Huldt.

“Our expectation is that a large portion of that will be reinvested into new funds that are being raised and that’s a key focus area for us when we’re looking at managers, because specifically in today’s market [there are] concerns about turning markets and a recession around the corner.

“We’re so strong about having alignment not only on the upside but also on the downside. You can only really reach that by having meaningful skin in the game.”

That being said, Huldt explained that AFA also looks to build long-term relationships outside of being an investor.

He told AltAssets the organisation is currently exploring its options to start to build an allocation to the infrastructure.

Since beginning its private equity allocations, AFA has seen the markets expand and evolve, taking with them both returns and lessons. In private equity AFA scored returns in the high teens last year, on a net-net basis in local currencies, which Huldt said the team were very happy with.

“If I look at the portfolio at the AFA for the last 18 years we have measured our performance, we have been over delivering versus our targets with a meaningful proportion.

Huldt added that seen its superior performance on a relative level as well, with the organisation’s private equity investments outperforming public equities.

With some managers boasting 20 years of investment and fundraising experience, you can be sure there were to be lessons to be learnt – but what can always be expected is a J-curve, Huldt said.

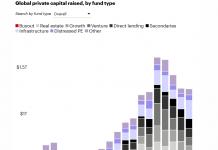

“Private equity was grouped together, you didn’t really distinguish between venture, secondaries, buyout and different sizes of buyout – everything was just private equity, I do think that the markets have evolved.

“You can now position your portfolio where it best reflects the mandate that you have, if you want a high risk (or are less concerned about liquidity) maybe a heavy allocation towards venture is the way to go, where if you are more concerned about maintaining downside and want a high proportion of liquidity coming back maybe you should have an increased allocation to secondaries.”

AFA is owned by a number of associations in Sweden’s labour market including Confederation of Swedish Enterprise, Swedish Trade Union Confederation and The Council for Negotiation and Co-operation.

The Stockholm-based insurer provides coverage to 4.7m Swedish employees in the private sector, municipalities and county councils.

Copyright © 2019 AltAssets