Poor liquidity and macroeconomic concerns have weighed heavily on private equity fundraising in the past year, with many firms stringing out their raises for far longer than previous in an attempt to hit their targets. Is it time to throw the private equity fundraising playbook out of the window? Aviditi Advisors CEO Ryan Schlitt and partner Anna Marie Curran explore how GPs need to approach fundraising in 2024 to avoid hitting a capital raising plateau.

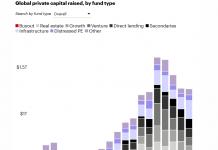

The private fundraising markets have been broadly challenging over the past 24 months. On average, the timeline to raise closed-end funds elongated across both 2022 and 2023, and the current market is witnessing a record number of funds in market. Meanwhile, it is estimated that 75% of institutions are at allocation, causing many funds to raise either modestly larger pools of capital compared to predecessor funds or in many cases smaller-sized funds. According to Preqin data, the average length of fundraises for private equity strategies across 2022 and 2023 was 19 to 21 months, which is a substantial increase from the 14-month average we observed from 2016 to 2021. Preliminary data from Preqin suggests that 2023 had the lowest number of closed buyout funds by count since 2014.

The dynamics for fundraising dramatically shifted during the period such that the repeatable playbook that many GPs successfully used in prior years is no longer effective, requiring new tactics to drive successful outcomes. Navigating this new capital raising environment is complex, and we find that many talented GPs deserving of a successful fundraise can find themselves at a plateau if they do not acknowledge the new fundraising realities and adjust their capital raising strategies accordingly.

Avoiding the plateau altogether

Upfront strategic planning and pre-fundraise organization are crucial in the current market. We find there are several themes behind successful fundraises with the primary drivers typically being:

Thoughtful launch timing

The days of launching the successor fund when the prior vehicle is ~70% called and committed are gone. In this environment, many LPs have a renewed focus on investing in seeded portfolios, so it’s important to be able to show an immediate need for the new fund capital to help drive efficiency in the process. Secondly, LPs want GPs to maximize their investment efficiency on their funds and thus drive better net results to them. Thirdly, LPs do not want to commit early and have an extended amount of time transpire between closing and the first investment being complete (the use of capital call lines has extended the time period already from which these obligated commitments are drawn).

It’s also important to consider any key upcoming milestones that will substantially strengthen the story prior to launching, such as key exits or crucial team hires. The line between “pre-marketing” and “marketing” has become increasingly blurred, and a GP might have only one opportunity with some LPs to pitch the current fund.

Given how long current fundraises are taking, there is no advantage in rushing to market prior to being fully prepared and maximizing your opportunities for success. In the words of a former boss, “in fundraising, it’s not when you start, but when you finish.” It’s important to maximize the likelihood of success by approaching when the story is as strong as possible. We find this to be particularly important for GPs who are raising their debut fund. Often when a new GP is starting out, their network is keen to assist them with intros to other LPs, but if the conversations are had too early when the firm and strategy are not fully developed, it can actually be detrimental to the likelihood of obtaining a commitment.

Clarity about support of existing relationships

In this environment, it’s important that GPs are able to demonstrate to new relationships what support they have from existing LPs.

For established managers, new LPs generally want to understand what “re-up” support will look like prior to beginning their work. In addition to providing an indication of how the investors who know the GP best feel they’ve delivered, this type of support also provides insight into the expected velocity of the fundraise. LPs are balancing constrained team resources with growing responsibilities across larger primary portfolios, coinvestments and secondary underwriting. Thus, it is important to demonstrate scarcity of capacity to encourage new LPs to prioritize a particular fundraise. Many new LPs will not begin their work when support of existing LPs is unclear.

For first-time funds, GPs find success either from firms who have supported them as fundless sponsors or from prior firms where the Principals have demonstrated success. This is nuanced as there are often non-solicit restrictions that new GPs must adhere to when departing prior firms.

Authenticity

Tell your story. It’s important to organize and synthesize your strategy in a manner that is cohesive when LPs underwrite and engage on due diligence. It’s incredibly intuitive, but we often find this core tenet can be ignored, with some GPs attempting to reverse engineer their strategy to appeal to current LP priorities. We’ve had great success at Aviditi and in prior roles raising “out of favor” strategies when the team is talented, and the underlying product quality is strong. Durability and consistency of strategy is a core tenet of LPs’ diligence from fund to fund. LPs quickly see through attempts to window dress a fund into the current on-trend strategy.

Realistic expectations about the environment

Funds going to market with an unrealistic target size relative to past investment activity or off market terms often end up taking longer to raise. Such mistakes in the current market can be extremely penalizing to GPs. There are, of course, instances where a substantial jump in fund size or premium terms are appropriate, but these are generally only tolerated by LPs when there is an exceptional track record and substantial demonstrable LP demand.

It’s important for GPs to also recognize that while it might be tempting for them to “test the market” prior to hiring an advisor, many advisors are less inclined to engage once a fund has been broadly brought to market. While there are advisors who work on “top up” mandates, it is generally a much more limited selection for the GP.

How to reignite LP interest when a fundraise has stalled

Once a fundraise has lost momentum, there are several tactics which can effectively reignite LP interest.

a) Seed the portfolio with assets. Many LPs are focused on funds where there is a seeded portfolio as it provides reduced blindpool risk and in some cases even helps to mitigate the J-curve through

an early portfolio markup. Additionally, the elongated fundraise timelines have made it the norm, not the exception, that LPs commit to seeded funds. For established GPs, where the successor fund involves new hires or a shift in strategy, there is also an opportunity for LPs to better underwrite the evolution of the firm through proper due diligence on the new asset(s). First time fund managers find this to be an effective means by which to illustrate their strategy and underwrite an investment alongside prospect LPs.

b) Co-investment continues to be important for many LPs, who view it as a core part of their GP underwriting processes. However, Aviditi observed that, in the current environment, many fund LPs have more access to fee-free / carry-free co-investment than ever before. Aviditi has found single deals previously catalyzed behavior on co-investment – however, in the current market, the larger state of overall co-investment relationships is more important given the increased number of co-investment deals seeking capital in the market. As such, it is as much a longer-term relationship building exercise as it is a specific fund investment catalyst tool.

c) Economic discounts have been utilized by GPs as a method to catalyze LP interest, though we caution that this tactic should generally only be used to pull timing forward. Economic incentives are generally not effective for garnering interest from an LP that is not already planning to do work but can be helpful in incentivizing some LPs to begin their work sooner.

Aviditi believes that the current environment necessitates a more thoughtful approach than ever in-terms of key aspects such as timing and relationships which can help a GP efficiently navigate a fundraise. Although avoiding a plateau all together is the ideal situation, there are strategic ways to regain momentum in the event a GP finds themselves at that point.

Copyright © 2024 AltAssets