A string of finance industry experts give AltAssets’ Karin Wasteson the rundown on what the banking crisis is doing to private equity’s dealmaking dynamics.

Private equity players are increasingly hitting dealmaking hurdles this year as the banking crisis continues to swirl and contagion fears abound.

The surprise failure of tech-focused US bank SVB earlier this month was quickly followed by the fall of 166-year-old European banking major Credit Suisse – and despite guarantees and talk of support from governments, much of the finance industry is on guard trying to gauge which institution could fall next.

While the crisis has been limited to the US and Europe so far, IMF managing director Kristalina Georgieva urged caution during an appearance at the 2023 China Development Forum on March 26, saying uncertainties surrounding the world economy were “exceptionally high”.

Amid the fallout from the pandemic, the war in Ukraine and rate hikes, the World Bank has warned that the economy is at risk of a “lost decade of growth”, with the situation eventually deteriorating if the current turmoil that is going on in the banking sector leads to a global recession.

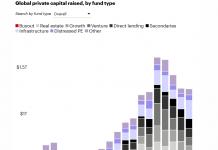

Indeed, chief economists are now saying a global recession in 2023 is increasingly likely. Global Data published a recent paper showing that M&A and private equity investments fell 71 percent in February this year, compared with the same time a year ago. There were 44 deals in total announced in February 2023 globally, versus 111 a year ago.

One analyst at a large investment bank with global operations, who didn’t want to be named, told AltAssets the decline in credit availability and liquidity has made it more challenging to finance deals and exit investments.

“Other than an overall widening of spreads in the markets, private equity firms are facing reduced availability of credit from banks and other lenders, as many financial institutions have become more cautious in their lending practices,” he said.

“As a result of this, we are increasingly seeing private equity firms relying on their own capital resources to finance deals, which can limit their ability to make large acquisitions. Also, they are turning to continuation funds as a way to manage their assets in the current market environment, waiting for financing markets to reopen and avoiding to sell at a perceived market discount.”

He highlighted the fact that not everyone might be in the same boat this time around, however. “On the banking side, bulge bracket banks are better positioned to support PEs in this banking crisis. Their large balance sheets allow them to absorb losses and manage risks. Because of this, they have more capital and liquidity to fund LBOs, or similar transactions, and this allows [these banks] to maintain their current, while fostering new relationships, with asset managers.”

In other words, some of the US´s largest lenders – including JP Morgan, Citi and Bank of America – will be able to continue to generate fees and profits from private equity transactions, which can be particularly valuable during a period of reduced profitability for the banking industry as a whole, according to the banking analyst.

Radhika Papandreou, managing partner in management consulting firm Korn Ferry’s Chicago office, has said the banking crisis is likely to further depress deal making. “Companies will be reluctant to lever up to buy and sell assets in the space,” she said.

Jeffrey Jones, a managing partner at The Deerborne Group, agreed that the current banking crisis is “absolutely” impacting private equity, as investors are getting “very nervous”.

“Money has gotten way more expensive to get. As such, private equity is holding onto their money and keeping their powder dry. They are telling their portfolio companies to make due with the money they’ve got and to make it last,” he explained.

“But you can only cut back so far. So companies are reducing spending, preserving capital, and laying off workers, the biggest expense on their books, in numbers we haven’t seen in a long time. The work still needs to get done though. Many are starting to outsource which will save them money in the long run.

“With interest rates rising, private equity can just reallocate investment and put it in the bank until the market settles down.”

That strategy relies on the banks still being there when the crisis is over, however. Time will tell if governments and industry majors have done enough to stem the tide.

Copyright © 2023 AltAssets