The majority of limited partners are bullish on North American and European private equity over the next 18 months – but sentiment on Asian buyout remains more lukewarm, data from the latest Coller Capital Barometer report shows.

About 60% of LPs believe 2023 will be a strong vintage year for North American private equity – rising to 71% for 2024, according to the survey of 110 PE backers from around the world.

About half of respondents believe 2023 will be a stronger year for European buyout, with just 19% suggesting it will be a weaker year. Those numbers improve to 71% and 5% for 2024.

Responses were more measured about the Asian private equity landscape, however – just 37% of those surveyed said 2023 would be stronger year, with 19% banking on a weaker performance. 2024 sentiment improved on that slightly, to 45% and 13% respectively.

Healthcare and pharmaceuticals are seen as the most promising sectors for private equity over the next two years, with 87% of LPs saying they look attractive.

About 75% of respondents highlighted IT and business services, while biotech also did well at 63%.

Renewables was mentioned as attractive by 69% of those surveyed, compared to just 49% for hydrocarbons – and sentiment for the consumer sector was rock bottom, at just 21%.

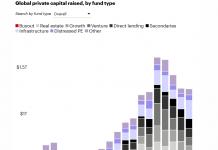

Coller’s report revealed that more than four fifths of LPs expect to see good investment opportunities for GPs in mid-market, lower mid-market buyouts and special situations in the next two years, while three-quarters of LPs expect good opportunities to arise in secondaries.

Significantly fewer LPs see attractive opportunities for growth deals, however, while just 11% cited megabuyout and 25% large buyout as good opportunities for this summer.

About half of LPs say that the current proportion of debt in buyout deals is too high, while only 4% of LPs think the level is too low

Two fifths of investors plan to increase their target allocations to private credit and infrastructure over the next year.

Within private debt markets, two thirds of LPs expect there to be a greater concentration of capital within larger GPs over the next three to five years, while for private equity, fewer LPs expect to increase their average commitment size to individual GPs than five years ago.

LPs are making room for new managers in their portfolios, however, with the majority making a commitment to a new private equity manager and over half of LPs adding new private credit and venture capital managers

Coller Capital CIO Jeremy Coller said, “Markets have been going through a long, challenging winter, so it’s good to see that investors are upbeat on the outlook for private capital and see signs of spring ahead.

“Being selective and choosing the right strategies and sectors to invest in will be key.”

Copyright © 2023 AltAssets