Three years of market uncertainty caused by Covid, Russia’s invasion of Ukraine and spiking global inflation have seen private equity secondaries soar in desirability for LPs. AltAssets’ Karin Wasteson takes a look at whether the industry can continue its record-breaking run into 2023 through chats with Blackstone Strategic Partners global head Verdun Perry, Whitehorse Liquidity Partners founder Yann Robard and the secondaries co-heads of Manulife Investment Management.

Secondaries private equity already had a consecutive pair of record deployment years under its belt going into 2023, with primary exit routes on-hold amid an ongoing string of macroconomic crises. The subsector’s trajectory has been clear since a dip in volume in the second half of 2020 – with investors briefly battening down the hatches while waiting to see what impact the ongoing coronavirus pandemic would have on businesses and markets. Speed quickly picked up again in H1 2021 with record $48bn of transactions closed, and the year ended up with volumes in line with the 2019 total. For the first time, GP-led transactions represented the majority of transactions, at about 60%.

Secondary transactions increased again in 2022, surpassing the previous year’s record total according to Jefferies’ global secondary market review. Jefferies states it expects a “gradual rebound” of the secondary market in 2023. At the same time, non-traditional secondary allocators such as alternative asset managers, sovereign wealth funds, buyout sponsors and pension plans have been increasingly entering the market – a trend that is expected to continue. Verdun Perry, global head of Blackstone Strategic Partners, believes the secondaries market is set up for a boom – but that surge might not come until after 2023.

“What’s interesting is that lots of the deals that were shelved or did not happen in 2022 have moved into 2023. In addition, some sellers are overallocated to private equity and they have to sell or want to sell to free up cash and liquidity. At the same time, you have distributions down in 2022 versus 2021 by about 50 percent, so there are lots of LPs that want liquidity,” he said. “This year might not necessarily be a record year, although I think we’ll come close to it. I think we will see between $120-130 billion in terms of volume market wide. Many deals will come to market in the first half of the year, but they will likely close in the second half.”

“I expect the GP led side to increase this year, just because there’s a little more clarity in the macroeconomic environment and there’s more clarity on where interest rates and inflation will ultimately go.” Due to fresh macro volatility and the denominator effect, LPs will look to rebalance their portfolios again in the coming months, until public markets recover further down the line. “Sellers might be selling to free up capacity to make new commitments. They’re staying the course. LPs are not saying: ´I’m going to stop investing in private funds´. They are looking to sell selective funds to get allocations back in line with targets, or to free up liquidity to increase flexibility to invest in specific managers.”

While previously a seller might have been looking for par, Perry states that the gap has narrowed because sellers have become more realistic in terms of their price expectations – i.e. they have lowered their expectations. “Last year, sellers’ price expectations had not yet caught up with reality. That gap has narrowed significantly,” he explained. “If you look at all unrealised value in private market funds, only about one and a half percent trades on the secondary market each year. One and a half percent is tiny. I would argue there are still lots of large owners of private market funds that have never sold on the [secondary] market,” Perry elaborated.

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation, a Canadian multinational insurance company and financial services provider headquartered in Toronto, Ontario. Its secondaries co-heads leads Jeff Hammer and Paul Sanabria believe it is important to look at what the macro-economic environment is telling us at the moment.

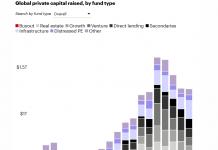

Hammer and Sanabria also believe the importance of the private markets to institutional investors is clear, and this will require a fully functioning secondary market as the need for liquidity will exist in good times and more challenging times. Growth will come from the core private equity secondary market, but also the development of adjacencies such as real estate, infrastructure, private credit, and venture capital. “What we’re seeing now is just the tip of the iceberg – in fact some in our industry believe the secondary market will grow to trillion dollars in transaction volume over the next ten years,” commented Sanabria.

Expert commentators all seem to have expectations of the secondary market heading towards significant growth ahead. Yann Robard, the founder and managing partner of Canada-based private equity firm Whitehorse Liquidity Partners, told AltAssets he believes that the secondaries segment is in a buyers’ market right now. “You have three elements that are causing a perfect storm right now: pent up demand from LPs for liquidity, not enough capital to address it and recapitalization of secondaries funds taking much longer than in a normal environment.

“Since March 2022 public markets have been going through fits and starts and that has essentially created even more pent-up demand for liquidity. Many who need liquidity haven’t even come to market yet,” said Robard. He said 2023 will be a record year for secondaries – albeit with a caveat. It depends on whether the market has enough capital to absorb the demand. “There is a large amount of deal flow from LPs that are still interested in generating liquidity, but there’s not enough capital [to absorb it],” he said.

Robard added, “Portfolios used to price high nineties to par on a buyout portfolio. Now 85 is the new 95.” It has taken some time for sellers, who were used to selling at single digit discounts, to adjust to a market that’s indicating double digit discounts. Robard continued, “Anytime there is market volatility you end up with a difference between buyers’ and sellers’ expectations. You need to work through that, and it does take a certain amount of time.”

Copyright © 2023 AltAssets