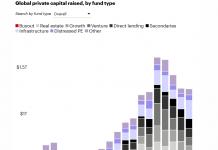

Record levels of capital are flowing into the private equity market, megafund levels have reached a pre-2007 peak, and European LPs are supposedly more eager than ever to invest in private equity.

But as the race to find value in a deal-sparse environment hots up, VBV PensionKasse’s Günther Schiendl is taking a different stance, with the LP deciding to watch private equity from the sidelines until the “hype” blows over.

He said, “We believe that in two years it will be a much better time to provide capital than it is today. We think this because it is over-hyped, too expensive, and there is too much money chasing with too few deals.

“We are not going to move away, but we are just not moving in because we believe in two to three years time that when you enter you will get better value.”

The Austrian pension fund will only commit capital to European private equity vehicles if it can find niche fund managers operating with high conviction in German speaking countries.

Schiendl added, “As a tradition, we are looking for focused managers in all types of asset classes tat have high conviction in what they are doing. If somebody’s an expert and has high conviction, then we think it is ok to select that particular fund, and then we do not have a need for so-called diversification purposes in the fund structure.

“It is very hard, but we believe yes. We do understand that it is difficult and highly specialised, and so far, we have not been able to find a suitable fund manager or product. So, we are not definitely sourcing deals. Lets say we are keeping an eye on the market.”

Schiendl also believes the traditional LP to GP structure is not something that is completely suited to VBV due to regulations.

“What we would like to invest in, in terms of private equity, is SMEs in continental Europe in predominantly German-speaking countries. Then we would be looking at other things like global private equity, but not at this time.

“I would say regulation matters in private equity, and this means the LP to GP structure is not optimal for us. We prefer structures that are fund structures, maybe managed by a fund manager that has an AIFMD. This is what we have seen for quite some time, so the typical vehicle in the private equity space typically is not an optimal.

“As a pension fund we are exempt from capital gains taxes, but in certain LP structures we risk getting infected with tax issues. This is the first thing, the other thing is the logistics for us as an LP on our pension plans. In a nutshell, we prefer AIFMD, an alternative investment fund type of structure typically domiciled in Luxembourg. Typical LP structures do not work for us.”

The pension fund now view direct lending as “the nucleus” of the private market, and that is where the promise of good returns and better value lies.

“Current EU regulation makes investing in less liquid asset classes more complicated and more tedious, which might not be a good thing, but trying to invest in private equity means investing in something that is illiquid and there are limits on the practice of this.

“In private lending is where I have more to say. The market has grown tremendously in Europe. When we entered the market, there were probably 12 or so direct lending managers out there. Today, I think it is over 70 or so. It clearly has the market and room for differentiation.”

Copyright © 2017 AltAssets