Advent France Biotechnology has held an €86m first close for its second fund, already surpassing the size of its debut vehicle in the strategy.

AFB Seed Fund II attracted investments from the European Investment Fund and the Fonds national d’amorçage 2, managed on behalf of the French State by Bpifrance. Other Investors include Boehringer Ingelheim Venture Fund, Pierre Fabre and an Asian pharmaceutical company.

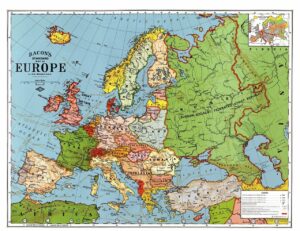

The firm said the new fund will be dedicated to early-stage investments in European life sciences companies with a focus in France, with a plan of backing two start-ups before the end of the year.

Alain Huriez, chairman and managing partner, AFB, said, “We firmly believe that early-stage financing is critical for the life sciences industry, where the needs are huge and still not met, especially in France.

“This second fund shows the relevance of our positioning as entrepreneur-investors in life sciences, confirmed by the renewed support of our limited partners. Our scientific ecosystem is rich with high-profile scientists and endless potential for breakthrough innovations, endorsed by the numerous emerging life sciences startups in Europe and the latest international deals in the industry.”

AFB was founded in 2015 with a primary focus on new drug discovery, enabling technologies and med tech.

It closed Seed-Fund I on €68m in 2017 and had made 15 investments in France, Spain, Belgium and Ireland including the creation of Gamut Therapeutics which was merged with gene therapy company SparingVision within less than a year. 14 of the investments were financed in syndication.

The firm said it will predominantly invest in Europe, with a focus in France, Spain and Belgium.

Copyright © 2021 AltAssets