The private equity industry has “seen its glory days” and future returns are going to be “average”, claims professor John Colley of Warwick Business School.

High valuations and increasing competition is a hot topic in the industry currently and some commentators have a more optimistic view than others.

Colley, who currently works as an advisor in the industry, believes that private equity investors will now find it hard to generate “super returns” because it is too easy to raise capital, and there is not enough targets.

He said, “The sense one gets is they have a lot of money to spend and there is not many targets. You look at the data and the amount of money being raised is rocketing each year. There is huge amounts of it around.”

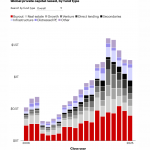

Last year saw close to $300bn raised across more than 380 funds, suggesting that next year’s figure could beat the $376bn collected through 519 funds in 2007.

“Most private equity funds are finding it very easy to raise money and I would say that most private equity businesses have substantial funds that are unspent. There is an awful lot of dry powder out there and they are all searching for opportunities.”

Across the US, there is around $95bn of dry powder currently being stockpiled. AltAssets reported earlier this year that global dry powder levels has hit $1.5tn, a record high.

A rise in the number of firms now raising capital and targeting opportunities has also led to increasing valuations, something that is the natural evolution of the market.

“There is clearly more private equity firms competing with each other. At one time, going back a few years, many private equity firms would actually say they would not compete with each other for business. So, they either got a clear run at it or they were not interested.

“Now they have no choice, and if you are a business seller, you are always going to run a beauty parade and make them bid against each other. In effect, they are bidding up prices and that is kind of the reality of it.

“That is what led me to the view that private equity has probably had its best day and returns in the future are going to approach the average.”

Colley believes that the lack of opportunity leads fund managers to bending the typical private equity rules, and could end up investing in places with more risk.

“Private equity has been incredibly disciplined about what they will do and what they wont do. You can’t raise more money until you have spent the money you have got, and the fact they have got so much money means they are going to end up compromising their own rules and start accepting more risk than they would have done in the past.

“It has become a victim of its own success. In reality it has been hugely successful, but at the end of the day, the super returns are disappearing out of it.

“In the future, I do not think we are going to see the returns that we have seen in the past.”

Copyright © 2017 AltAssets