European pension investment major Ilmarinen has been steadily growing its allocation to private equity over last 20 years – and has seen the market grow to an immense scale and become increasingly fragmented in that time.

AltAssets spoke with Ilmarinen’s senior portfolio manager for private equity, Katja Salovaara, who explained how Finland’s biggest mutual pension insurance company built up its allocation to PE from less than €100m to about €3.5bn today.

In an interview with AltAssets four years ago Salovaara said the LP was looking to increase its target to 7 per cent by 2020 – and it has hit this goal at least year early, providing testament to the attractiveness of the market.

“It has been our best performing asset class over the long-term and we have been committing to the asset class with a target to achieve return premiums over listed equities and so far we have achieved it,” Salovaara said.

Ilmarinen’s net returns for private equity since 2005 to the end of 2017 stood at 17.1 per cent per annum, and outperformed the organisation’s listed equities portfolio by 770 bps.

Salovaara said, “I’ve been here for 19 years, and we had less than €100m [in private equity] – so around 0 per cent – when I joined, and it has really been a gradual increase in our target and a significant increase in the actual size.”

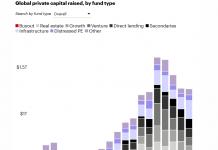

Ilmarinen is just one of the European institutional investors bumping up its exposure to in the private equity market, seeking decent returns in a low interest rate environment.

Pitchbook data shows average fund size in the European private equity buyout market has jumped 35.5 per cent to $1.1bn since last year. European private equity houses pulled in about €66bn in 2018 across 67 funds.

“I think the fundraising market has been really strong in the last few years, but I think it’s also bifurcated, that you have the largest funds that are oversubscribed and really quick [fundraises], whereas on the other end of the market there is much slower fundraising and portion of those end up below target as well,” Salovaara said.

She added that in a market like this, investors must have a very high conviction, be very organised and do their work early.

Other Nordic LPs have said that GP fees are currently fair, considering the management the assets require – Ilmarinen, however, is wary of fee levels in some areas of the market.

Salovaara said, “We are sensitive to fees, so some parts of the market are not for us and we have brought down fees by doing things in a more direct way, so we co-invest with our managers.

“It’s a wide variation in terms of the fee levels and the fine print of those [LPAs], and I think there are some [funds] out there which are too expensive and misaligned even.

“I’ve seen a major fund term sheet with calculations based on gross portfolio returns, ignoring the 2 per cent management fee, I think that’s misaligned and not for us.

“In private equity it’s always 50 shades of grey – it’s not black and white.”

Salovaara not only has words for current fee levels, but also the liquidity premiums offered by the asset class. “I don’t believe in the existence of a liquidity premium in private equity,” she added.

“I don’t think you get beta premium for allocation to the asset class, because the returns are linked to the managers and not to the asset class, so the premium has got to come from active ownership and navigating this complexity in the asset class.”

Ilmarinen has also been bulking up its co-investment strategy alongside its fund investments, and 15 per cent of the portfolio is currently deployed in co-investments.

“We have increasingly over time been investing more directly, so on the PE side we have invested through co-investments in companies with buyout funds. So we’ve been doing the co [investments] on the PE side since 2010.”

The pension insurance company is attracted by the strategy’s ability to limit fees levels but also the greater control over the investment.

Salovaara said that the biggest benefit is that it allows Ilmarinen to know its managers a lot better as well as becoming better investors in terms of picking fund managers.

“This is a very underestimated part of our co-investment activity because we are doing this ourselves in house.

“I have a colleague that is fully focused on co-investments and I work with him closely as much as possible because that way we get real-time market information and get to know our managers a lot better.

Alongside its increased investment to private equity, Ilmarinen is looking to increase its allocation to private debt, infrastructure and real estate.

“On the real estate side, as well we are not talking about funds, but we have increased our investments and are increasing our investments in real estate, in joint ventures, outside of our home Finnish market.

“So it’s more direct investment, and similarly on the infra side as well we are pursuing funds and co-investments.”

Copyright © 2019 AltAssets