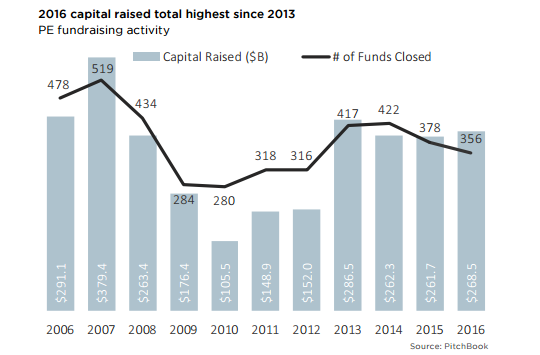

Private equity fundraising scored one of its highest results in a decade last year, marking the fourth consecutive strong year for capital commitments to the asset class.

LPs are increasingly leaning on their PE allocations to keep returns stable in the face of public market volatility and underperformance from other alternatives according to PitchBook’s latest annual PE and VC fundraising report.

It said capital committed to buyout funds in North America and Europe totaled about $268bn, a 2.6 per cent increase on 2015.

That figure has only been outstripped in the last decade by the $286.5bn collected in 2013, and soaring results from the pre-financial crisis boom years of 2006 and 2007.

The number of funds that closed, however, decreased by 5.8 per cent to 356 new vehicles, the report revealed.

It said, “To say that PE fundraising has departed from its financial crisis struggles would be an understatement.

“On average, $269.7bn has been committed to PE funds in each of the last four years, compared to just $145.7bn in the years from 2009 to 2012.

“The PE fundraising market experienced its usual fourth-quarter rush last year. 86 funds closed in 4Q 2016, garnering $80.3bn in commitments, the most of any quarter in the last two and a half years.

“We’re all well aware that past performance does not necessarily predict future returns, but sometimes looking at past performance is a necessary tool LPs must use when allocating capital.

“Using our most recent data showing returns through the first quarter of 2016, PE outperformed the Russell 3000 index on one, five, 10 and 15-year horizon.

“What’s more, net cash flow to LPs has been positive every year since 2011.

“With pension funds in the US facing growing obligation deficits, sovereign wealth funds of petro-states looking to diversify into PE for the first time, and PE having shown past outperformance over other asset classes, it’s no wonder that LPs are plowing capital back into these funds at such a fast pace.”

Almost 90 per cent of funds raised hit their stated targets last year, the report added – the highest figure the data provider has ever recorded.

Despite the strong performance, PE commitments fell by 8.9 per cent in the US last year to $182.6bn across 33 fewer funds.

Capital commitments in Canada and Europe, however, leapt by about 40 per cent and 34 per cent respectively.

A total of 13 funds held final closes last year with commitments in excess of $5bn – the most since 2013 and the third most of any year in the last decade.

PitchBook said, “This jump can be attributed in part to simple chance or the cyclicality of the largest funds.

2A fund of that size which delays a planned December close until the first quarter of the next year can skew fundraising figures considerably.

“It should also be noted, however, that some LPs are choosing to cut the number of PE firms that they work with, sticking with larger and more established investors in times of uncertainty and hoping to cut administrative fees in the process.”

Copyright © 2017 AltAssets